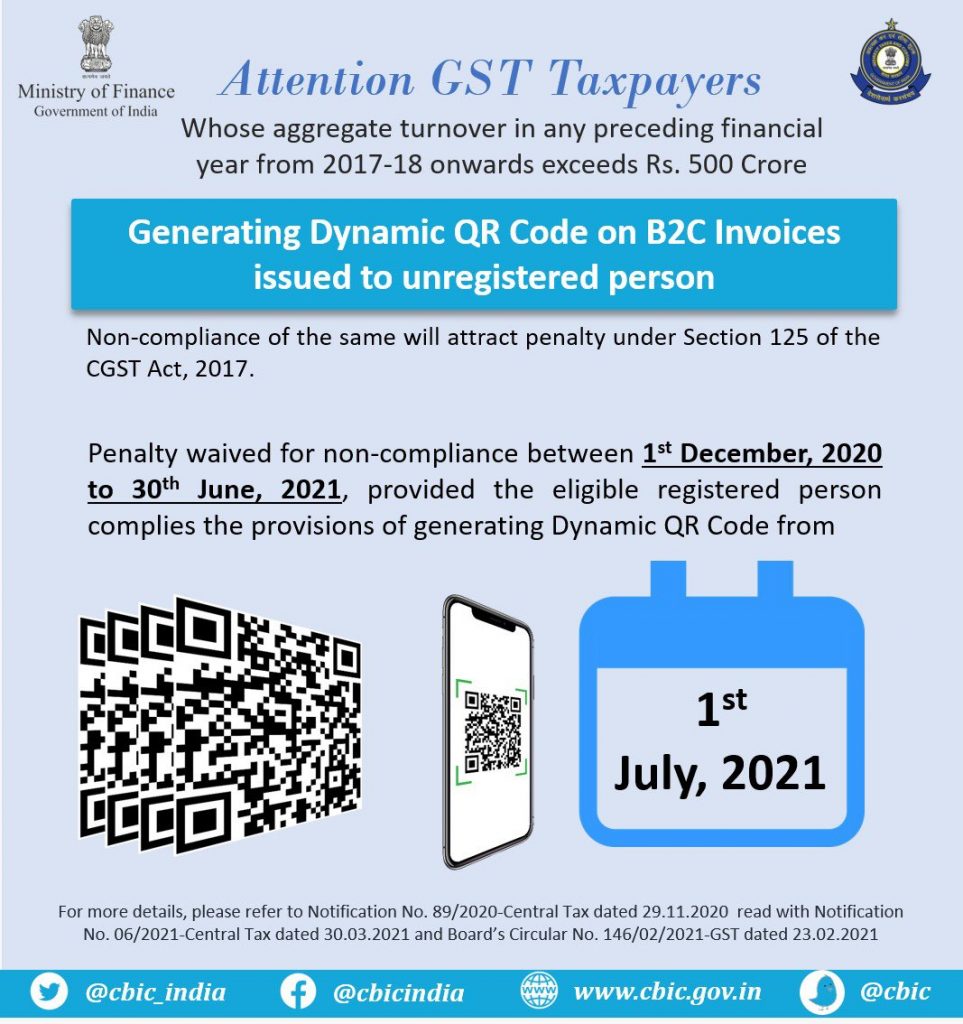

Attention GST Taxpayers whose aggregate turnover in any preceding financial year from 2017-18 onwards exceeds Rs.500 crore! Generating Dynamic QR Code on B2C Invoices issued to unregistered person. Penalty waived for non-compliance subject to conditions provided

0 Comments