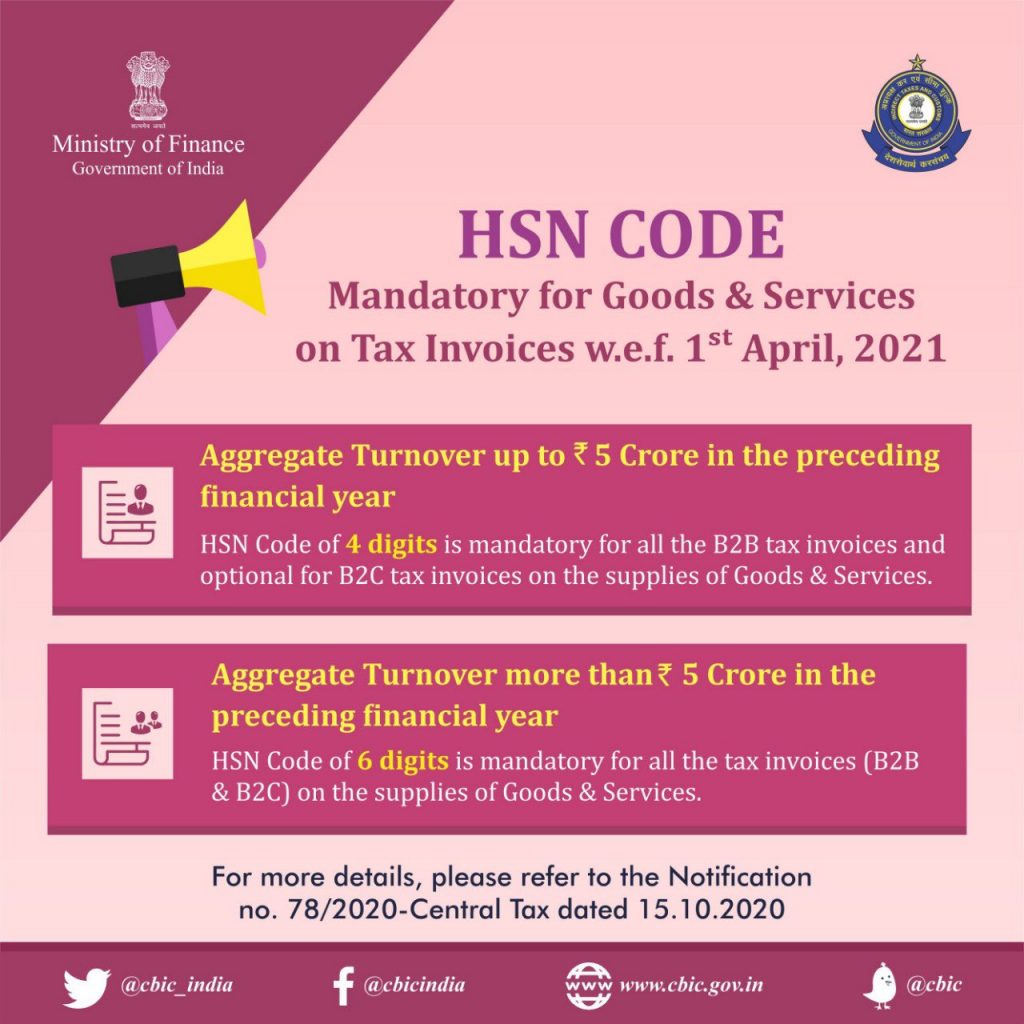

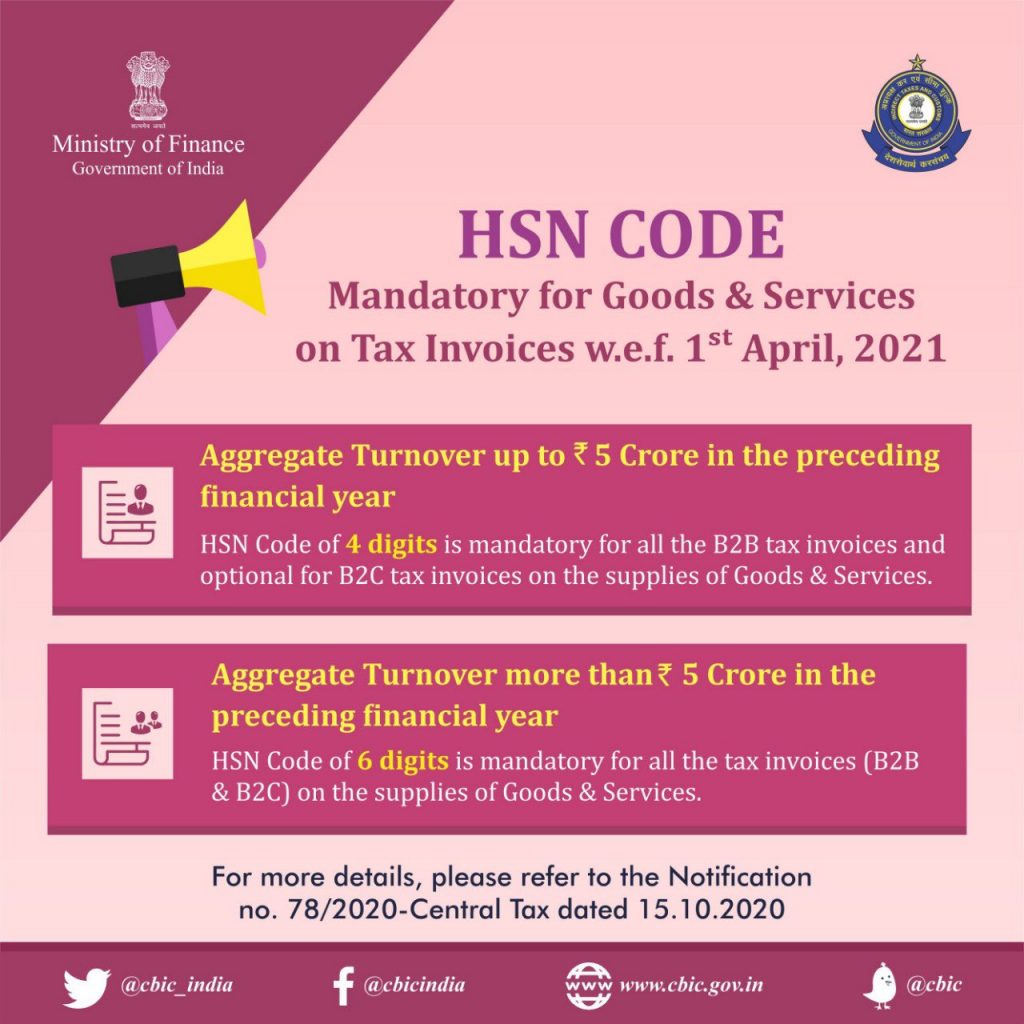

Requirement of HSN/Service Accounting Code for Goods and Services on B2B Tax Invoices is mandatory w.e.f 01/04/21 Turnover more than 5 crore in preceding FY – 6 Digits HSN Code Turnover upto 5 crore in preceding FY – 4 Digits HSN Code

support@canimesh.com

Requirement of HSN/Service Accounting Code for Goods and Services on B2B Tax Invoices is mandatory w.e.f 01/04/21 Turnover more than 5 crore in preceding FY – 6 Digits HSN Code Turnover upto 5 crore in preceding FY – 4 Digits HSN Code

Relevant GST Provisions – Construction of Immovable Property and ITC Under the GST law, Section 17(5)(d) of the CGST Act, 2017 blocks input tax credit (ITC) on goods or services used for the construction of an immovable property (when capitalized), except for "plant...

The Hon’ble Madras High Court in M/s. D. Y. Beathel Enterprises v. the State Tax Officer [W.P. (MD) Nos. 2127, 2117, 2121, 2152, 2159, 2160, 2168, 2177, 2500, 2530, 2532, 2534, 2538, 2539, 2540, 2503 & 2504 of 2021 & Ors., dated February 24, 2021] quashed the...

0 Comments