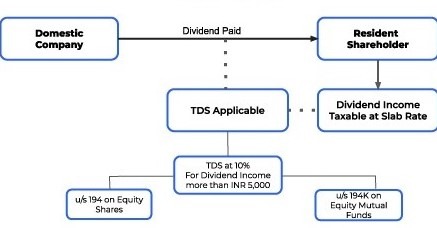

TDS on Dividend received from Company or Mutual Fund

👉🏻Any person who receives Dividend from any Indian Company/Mutual Funds more than Rs. 5000 in a year from that company/Mutual fund are subject to TDS @10% as per Section 194 with effect from 01-04-2020.

👉🏻To avoid such TDS Share holder/unit holder may submit form 15G/15H in the company or Apply for Nil/Lower TDS certificate from Income tax department and submit the same in Company.

Note: If TDS once deducted than you can get it refund by filing of Income tax return Only.