TDS Update

Due date for Furnishing of TDS/TCS return for Q4 FY 2019-20 is extended to 30.06.2020

Due date for Furnishing of TDS/TCS return for Q4 FY 2019-20 is extended to 30.06.2020

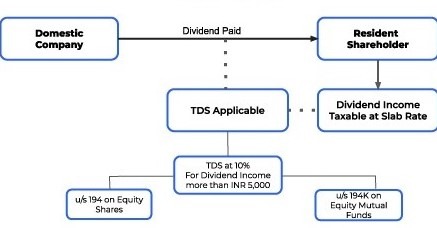

👉🏻Any person who receives Dividend from any Indian Company/Mutual Funds more than Rs. 5000 in a year from that company/Mutual fund are subject to TDS @10% as per Section 194 with effect from 01-04-2020.

👉🏻To avoid such TDS Share holder/unit holder may submit form 15G/15H in the company or Apply for Nil/Lower TDS certificate from Income tax department and submit the same in Company.

Note: If TDS once deducted than you can get it refund by filing of Income tax return Only.

🔗 Section-197

👉Assessee who has availed No TDS/ Lower TDS certificate in FY 2019-20 will be valid till 30-06-2020 irrespective whether application for FY 2020-21 has been filed or not.

Note: Such Application can be made through Online portal💻 or E-Mail📧